Alexandria City Real Estate Assessment

[Current] Office of Real Estate Assessments | City of Alexandria, VA

Office of Real Estate Assessments Popular Links - Search Property & Sales Data - 2026 Request for Review Form (The Deadline for Submission is March 16, 2026) - Sample 2025 Notice of Assessment - Sample 2025 Notice of Assessment (Spanish Translation) - 2025 Assessment Notice Insert - 2025 Assessment Notice Insert (Spanish Translation) - 2025 Stormwater Utility Fee Insert - GIS Parcel Viewer - View Parcel Maps - Mailing Address...

https://www.alexandriava.gov/RealEstate![[Current] Office of Real Estate Assessments | City of Alexandria, VA](screenshots/alexandria_city_real_estate_assessment_1.jpg)

[Current] Real Property Assessment Information | City of Alexandria, VA

Real Property Assessment Information Overview The overall year-over-year, locally and non-locally assessed tax base increased 2.57%. Demand for existing residential single-family properties and condominiums resulted in an overall 4.55% increase to the residential assessments. The multi-family rental sector continued its decrease a further 1.11%.

https://www.alexandriava.gov/real-estate/real-property-assessment-information![[Current] Real Property Assessment Information | City of Alexandria, VA](screenshots/alexandria_city_real_estate_assessment_2.jpg)

Alexandria: list of property taxes and fees (Sept 2025)

The city's assessment process involves professional appraisers who ... -Alexandria Property Market Forecast 2025-2026. -Average Rental ...

https://sandsofwealth.com/blogs/news/alexandria-property-taxes-feesAlexandria Township, NJ | Here is my 2026 Alexandria Township housing market prediction | Facebook

I am a local Realtor who lives in Alexandria. And, while we do have neighborhoods here with larger lots, 6 acres would be hard to find without spending millions. Going farther South into Prince William/Stafford or Fredericksburg would be an option.

https://www.facebook.com/groups/alexandriatownship/posts/10163411975643830/

[Current] Real Estate Assessment Review and Appeal Process | City of Alexandria, VA

Real Estate Assessment Review and Appeal Process Overview The real estate assessment Review and Appeal process begins when Notices of Assessment are mailed in early February of each calendar year. Property owners who contend that the assessed value does not represent the fair market value of their property as of January 1 (effective date) for the assessment year, or that the assessment is not equitable with comparable properties, or is...

https://www.alexandriava.gov/real-estate/real-estate-assessment-review-and-appeal-process![[Current] Real Estate Assessment Review and Appeal Process | City of Alexandria, VA](screenshots/alexandria_city_real_estate_assessment_5.jpg)

Alexandria plans budget cuts across all departments amid ...

Alexandria plans budget cuts across all departments amid economic uncertainty ; February 24, 2026 – City Manager's Proposed Budget Presentation ...

https://www.alxnow.com/2025/11/03/alexandria-plans-budget-cuts-across-all-departments-amid-economic-uncertainty/Trends and Demographics - FY 2026 Advertised Budget ...

The Real Estate Tax analysis includes the proposed FY 2026 Real Estate tax rate of $1.14 per $100 of assessed value. It is important to note that the ...

https://www.fairfaxcounty.gov/budget/sites/budget/files/Assets/Documents/fy2026/advertised/overview/Trends%20and%20Demographics.pdfYour Real Estate Tax Assessment: What Does It Mean? | Goodhart Group

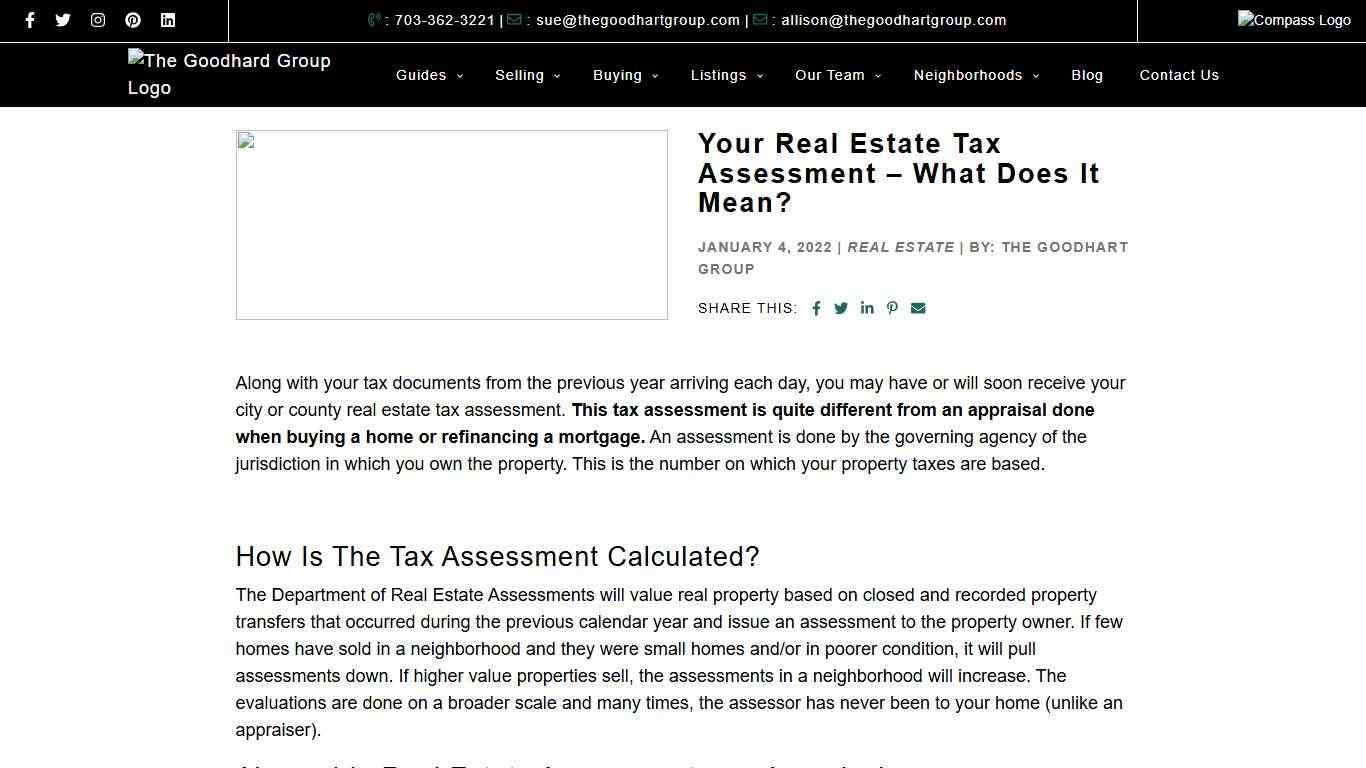

Along with your tax documents from the previous year arriving each day, you may have or will soon receive your city or county real estate tax assessment. This tax assessment is quite different from an appraisal done when buying a home or refinancing a mortgage.

https://www.thegoodhartgroup.com/tax-assessment/

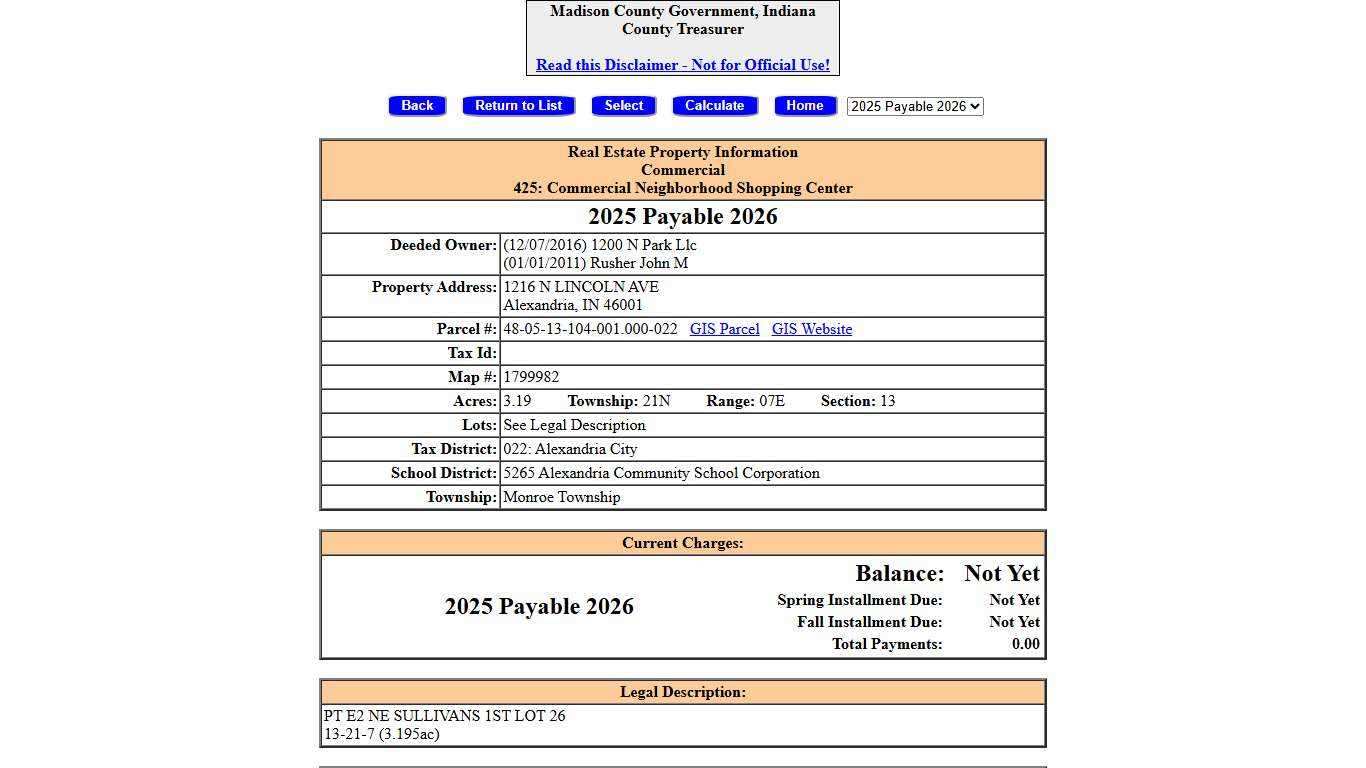

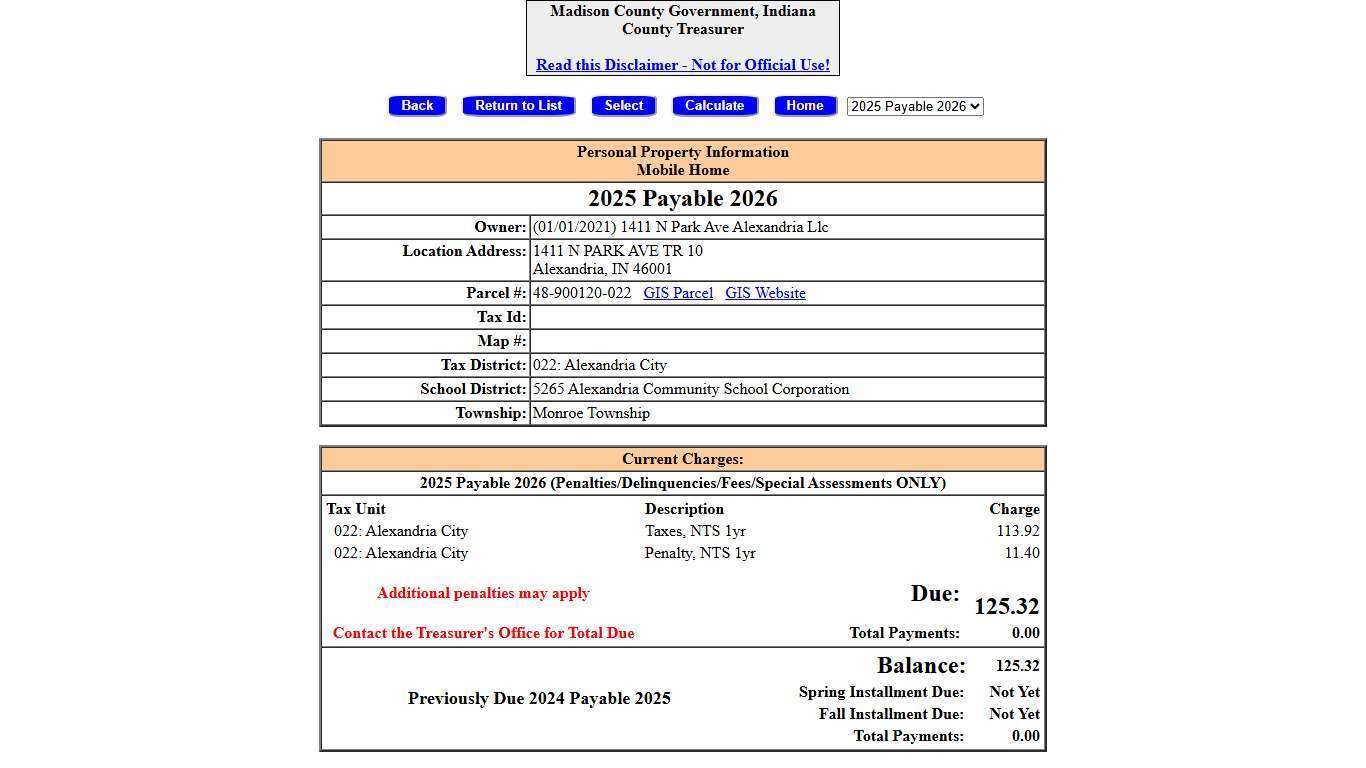

County Treasurer: Real Property Information

2025 Payable 2026. Deeded Owner: (12/07/2016) 1200 ... 022: Alexandria City. School District: 5265 ... Gross Assessment. 179,700, Cap 3 - NonRes Land.

http://treasurer.madison.in.datapitstop.us/cgi.exe?CALL_PROGRAM=C009INFO&FINDINFO=00001267804&TAXYEAR=2025&ORIGIN=B

Assessor Office - City Of Alexandria

The Assessing Department directs and manages the valuation and classification of all real property in the City, consistent with Minnesota Statutes and acceptable assessment practices with the goal of excellence in accuracy, transparency, and efficiency. Core Duties: - View, physically inspect, measure and value parcels of property in accordance with a five year viewing plan and as otherwise necessary.

https://alexandriamn.city/city-department/assessor-office/

Real Estate Taxes and Payments – Official Website of Arlington County Virginia Government

Real Estate Taxes and Payments The Real Estate Assessment Departments’ staff members are available by phone, email or virtual video meetings. In-person meetings, and document pick-up are available by appointment only. You may reach an Appraiser for further assistance or to set up an in person appointment by emailing [email protected] or calling (703)-228-3920.

https://www.arlingtonva.us/Government/Topics/Real-Estate/Tax-Payments

Northern Virginia Property Tax Guide 2025: Rates, Changes & What They Fund - Your Heels on the Ground Broker

Northern Virginia Property Tax Guide 2025: Rates, Changes & What They Fund Michelle Williams Your Heels on the Ground Broker Northern Virginia home buyers and owners often ask about local property tax rates and how those taxes support the community. In this comprehensive guide, we break down the 2025 property tax rates for key Northern Virginia localities where MMK Realty is most active – Fairfax County, Arlington County, the City...

https://www.mmkrealtyllc.com/2025/04/15/northern-virginia-property-tax-guide-2025-rates-changes-what-they-fund/

Your Real Estate Tax Assessment: What Does It Mean? | Goodhart Group

Along with your tax documents from the previous year arriving each day, you may have or will soon receive your city or county real estate tax assessment. This tax assessment is quite different from an appraisal done when buying a home or refinancing a mortgage.

https://www.thegoodhartgroup.com/tax-assessment/

County Treasurer: Real Property Information

Alexandria, IN 46001 USA. Tax Calculations for: 2025 Payable 2026. Description, Amounts. Gross Assessment ... Alexandria City, Penalty, Fall, 1.01. 022: ...

http://treasurer.madisoncounty48.us/cgi.exe?CALL_PROGRAM=C009INFO&FINDINFO=00036234687&TAXYEAR=2025&ORIGIN=B

[Current] Real Estate Tax Information | City of Alexandria, VA

Real Estate Tax Information Make a Real Estate Tax Payment Overview The City of Alexandria levies a tax each calendar year on all real estate located in the City that is subject to taxation. Residential and commercial property is assessed at 100% of the estimated fair market value as of January 1 of each year.

https://www.alexandriava.gov/RealEstateTax![[Current] Real Estate Tax Information | City of Alexandria, VA](screenshots/alexandria_city_real_estate_assessment_18.jpg)

| otr

(Washington, DC) - The Office of Tax and Revenue (OTR) will host its annual Tax Practitioner’s Institute on Tuesday, January 13, 2026, beginning at 9 am. The workshop will be offered in a hybrid format, with an in-person session at 1101 4th St.

https://otr.cfo.dc.gov/

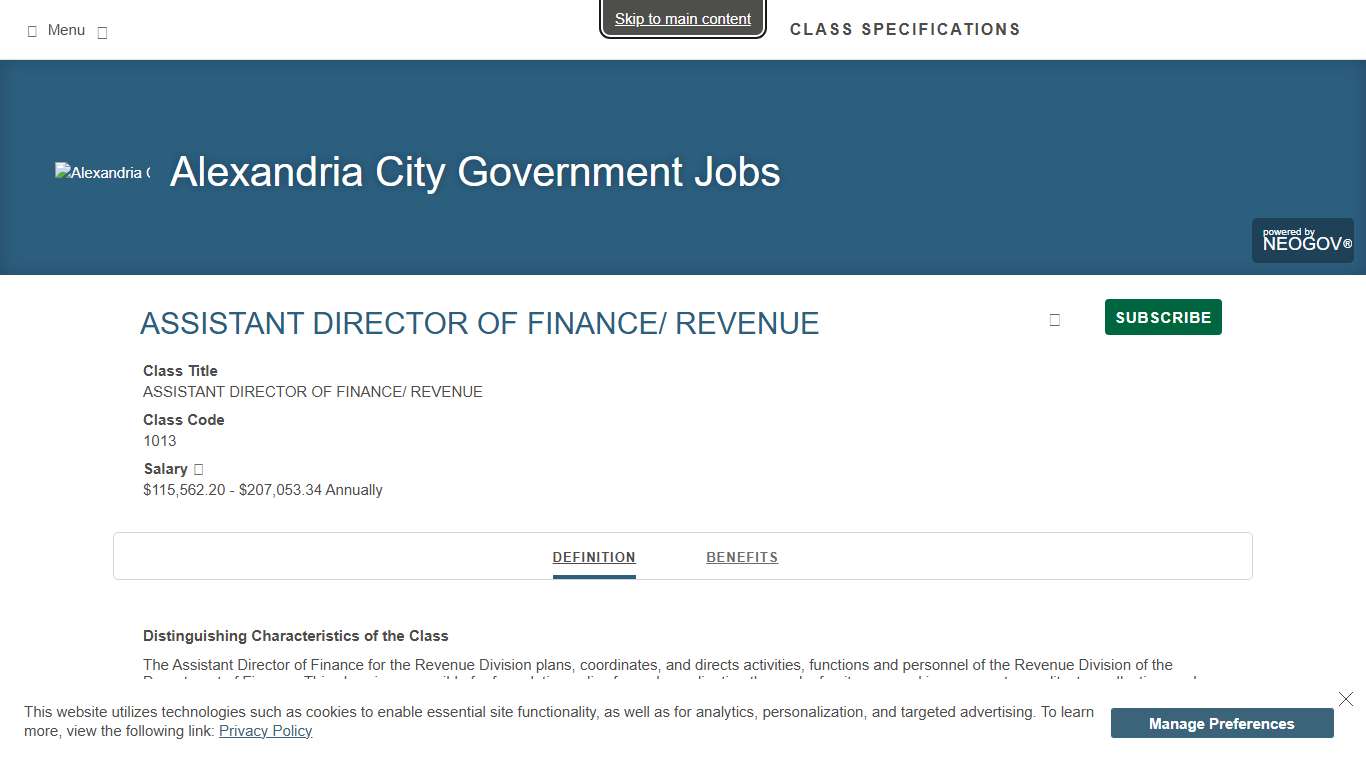

Class Specifications | Alexandria City Government Jobs

Effective date: August 19, 2025 NEOGOV PRIVACY POLICY Contents - 1.Introduction; Scope of this Policy. - 2.Where We Are a Service Provider. - 3.Personal Data We Collect About You and Why. - 4.Cookies and Similar Tracking Technologies. - 5.Online Analytics and Advertising.

https://www.governmentjobs.com/careers/alexandria/classspecs/76339